Managing taxes, understanding your terms and conditions with your employee and the overall legal formalities in the country you work for are crucial and unavoidable.

Working for an employer outside your state or country is a liberty that most people can’t have. “Remote job employees have problems keeping track of their numbers and record”, says Lior Zehtser, a Canadian CPA.

That might be true but not helpful down your career. To be on the safe side and not get stuck in the tax dilemma, follow along the article to get insights on how you can have a remote job without the stress on legal formalities.

You need to have a clear

guide to working remotely and with this article, you can save money before paying your taxes. You don’t want to end up stressing every year after seeing that big sum threatening you.

Know your remote job role

Not all roles are made equal in the eyes of the law and every country has a different code of conduct.

Especially if you are working in the Asian timezone, you need to be aware of the state laws and the country laws whenever you take a remote job.

To start things off, first categorize the role you will be opting for. Although there aren’t strict distinctions among the types of remote job workers, the roles show important parameters that differentiate them.

The independent contractor

A remote contractor who works for a firm is deployed to work for a specific term with the company for the conditions and guidelines given in the remote contract agreement.

To put this in Layman's terms, you work for a company remotely according to the wages you agreed to in the contract.

The advantage of being an independent contractor is that you can work for more than one firm at a time.

The downsides to work as a remote contractor is you don’t get the extra benefits that a regular employee receives.

Remote Employees' benefits

The Full-time employee

The employee who works a

remote full-time job is dedicated to working for one firm at a time and is provided with the benefits of the company is considered to be a full-time employee.

Unlike the contractor, in a remote job, the full-time employee may receive training from a senior and then get deployed into the business operations.

As a full-time employee, you will have to report about your regular work to your employer, get insights and material to improve in your remote job.

The Remote freelancer

While freelance also comes under the category of remote jobs, it is quite different.

Freelance work is done on a project basis and in most cases, the relationship with the client is terminated once the project is done.

This also means the taxes levied and the legalities for freelance work is different from a

remote job worker.

Remote freelance jobs being more popular as the gig economy is growing, are short term, and focus only on the project’s completion.

The remote freelancer who is technically self-employed can have better tax cut benefits than the remote job worker and it is important to know what your country’s laws say about it.

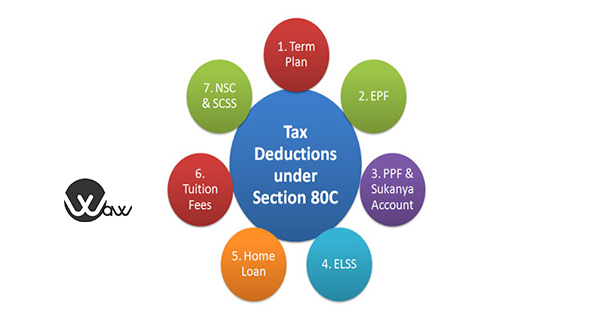

Taxation for remote job workers

Tax bills are always a concern if you are just entering into any sort of job and remote jobs are no exception.

Working from another country

There are little or no new implications to be followed if you work a remote job for a firm which is from your state. This makes things easy as you and your employer will be clear about what the taxes are in your state.

Out of your state or your country, it is a different field.

In Asian countries, a full-time remote job employee may find it less difficult to move in as there will be support from their employer. If you don’t belong to the same country, there is a mode of tax payment called PAYE.

PAYE referred to as pay-as-you-earn is a system where you get paid after the taxes are calculated and deducted. So your employer pays the taxes on your behalf by taking it from your monthly wages.

Even before getting employed, ask your employer or accountant about the jurisdiction they have to pay their taxes and be comfortable to communicate virtually. It is essential to know how they will get paid either directly or through a third party umbrella company and get clarified about the tax invoices they will receive.

Minimum wages

If you work outside your home country, the central and state governments would have decided on the minimum wages for the sector you work under.

Usually calculated on a per hour basis, the state and central government do not have the same wages. Since you will be working remotely, you need to find out the country’s minimum wages and check that your employer does not pay you below that.

Double taxation

With the world’s largest share of remote job workers coming from the Asia Pacific region, double taxation is something you simply cannot avoid.

This is because the clients you meet up around the world are from different countries outside your region. You don’t want to be paying two governments at the same time, do you?

In India, the government has a treaty called DTAA (Double Taxation Avoidance Agreement) that allows you to pay taxes only for the residential income and exempt the income earned from other countries.

Other Asian countries including Vietnam, Thailand, and Singapore have signed this treaty, making it easy for you to take clients within the Asian Timezone, and get exempted from the income you get from other countries.

How to manage taxes while working a remote job

If you were wondering if it was possible at all, you have good news.

As a full-time employee working a remote job, there is a lot of room to save some money going into the hands of the government. With all the above knowledge on taxes, you now need to find ways to reduce the overall taxes if you want to save some cash and not burn them out.

First things first. Always keep a good sum left in a savings account to pay your taxes. This makes sure that you don’t run into trouble at the last minute to pay your taxes.

Home office deduction

Home Office for remote workers

As a remote job worker, your home office is your biggest investment.

Your home workstation can help you save a lot before paying your taxes. There are certain conditions for this though and it depends on what your company provides for you.

Most companies provide laptops or a desktop to their remote job workers but on the flip side, the workers have to pay for the internet connection in most cases.

Most remote job employees fear that this might lead to an audit in the future but that depends. As long as it satisfies the following criteria, you are good to go.

-

The home workstation must be dedicated for business use only.

-

It should be used regularly (although there is no clear definition for regular usage)

The deduction is calculated as a ratio of the area of your workstation and the area of your house. By this way, you can save a lot before paying your taxes.

Keep the details ready

When it is time to pay the taxes, you don’t want to be in a rush to find and organize all your receipts.

As you are in a

remote job, you can do virtually everything. Choose a cloud-based financial software like

Freshbooks where you can keep all the tax invoices in one place.

Accuracy is key and I would advise keeping any records related to tax expenditures as a proof. This is to ensure you are on the safe side just in case a claim is raised regarding the reason for the deduction.

Freshbooks

Have a retirement plan

An easy and effective way would be to choose a retirement savings plan like a 401k retirement plan. When you work in your remote job, you will contribute a particular portion of your wages to your retirement plan.

The best part is this is done before taxation. For instance, if you get $1,000 and contribute $100 as that month’s contribution, you will be taxed for $900 only.

Although there are limits to how much you can contribute and it varies with the country you work from.

Retirement plans for remote workers

Cut and claim your expenses

In cases where the company does not sponsor the workstation with the software tools you need, you may have to end up buying the licensed versions of them.

You can consider them if you want to claim the expenses and ask for a tax reduction. Additional equipment for the designated remote job comes into the picture as well.

The miscellaneous expenses must be mentioned as well. In case you have to travel on behalf of your company for a meeting or a convention, you can deduct the mileage costs.

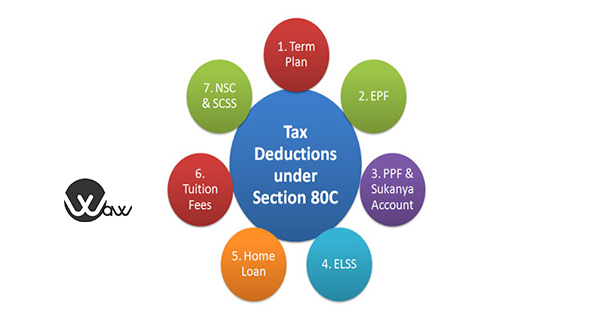

Beware of the threshold

With all that being said, there is always a threshold that you should check and abide by. The number one thing remote job workers should do is to itemize their expenses.

Without that, you cannot ask them to be written off. This is where we ask you to choose accounting software that will do that work for you.

Depending upon the country, you might be levied a percent of the deduction expenses below which they cannot be deducted.

Take India for example. If you work remotely from India, it depends on two scenarios. If your employer who might be outside the country deducts taxes at TDS (Tax Deduction at source) you don’t have to pay in India.

In the other case, if the former does not happen, you will have to pay taxes in India.

There is a 2% tax deduct threshold where you can only make claims on expenses above the 2% of your total wages. This is a scenario in the United States and it is important to check what the case is in the country you will be working from.

Before concluding the article, you need to understand that the landscape of remote jobs and legal formalities around it may change annually. Hence being in a remote job, it is your responsibility to check what updates are before you get into deep waters.

Tax deductions for remote workers

Why choose Waw Asia for remote jobs in Asia

Asian

remote job candidates have tons of potential but the opportunity seems to be scarce in the continent. Being the best time to start your

remote job venture, you need the

best remote job portal in Asia that provides legitimate

remote jobs.

Waw Asia has global recruiters looking for great talents from the Asian timezone and it will be the best choice that you will make for your career.

What are you waiting for?

You are one step away from

signing up to our website where you can then start searching for your

remote job.